THE ROBOTS ARE COMING

But should we be worried they are going to take our jobs?

Posted by Mike FitzGibbon on November 18, 2018

The robots are coming and, if the

headlines are to be believed, jobs as we know them are doomed.

But forgive me if I’m not running for

the hills – or reconsidering my choice of industry – just yet.

In fact, quite the opposite.

Unless you live in a news-free bubble,

you’d be aware advances in machine learning and Artificial Intelligence (AI)

are likely to drastically change the jobs of the future. Some claim

between 30 and 80 per cent of the jobs we do today will become obsolete.

The insurance sector is seen as

fertile ground for this ‘invasion’ - given its relative lack of disruption and

innovation to date - with the claims space in particular

considered ripe for the taking.

The Guardian was one of a host of

international outlets that picked up and ran with this story from Japan recently:

“A future in which human workers are

replaced by machines is about to become a reality at an insurance firm

in Japan, where more than 30 employees are being laid off and replaced

with an artificial intelligence system that can calculate payouts to

policyholders.”

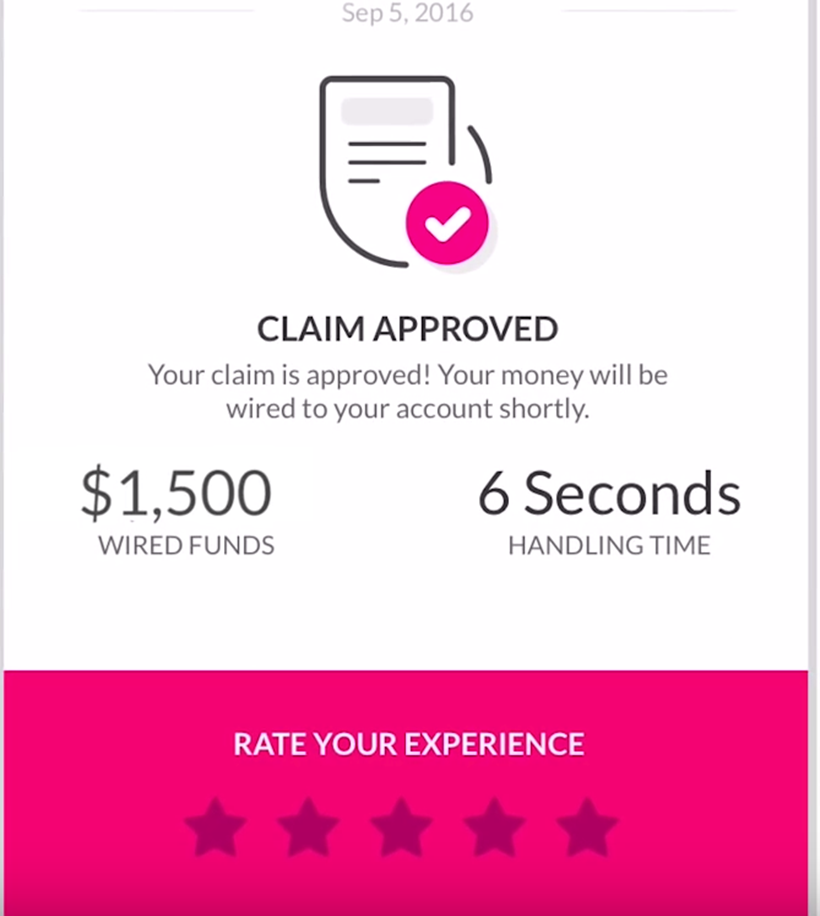

Insurance newcomers like ‘Lemonade’,

meanwhile, are adding to the hype with promises of using technology to pay

claims within 6 seconds.

Yes, significant changes as a result

of technology are inevitable. But does this mean the roles we know today will

disappear completely?

No. And conversely, the opportunity for

new and improved roles in the coming years looks more promising than ever.

Here are four reasons I don’t see robots

taking the job of claims managers in the area I work in; life insurance.

1. Technological

change happens slower than we think

Consider the fact that as much as 80

per cent of all life insurance claims are still submitted as a hard copy form.

Forget about a robot doing anything,

we haven’t even digitised the form!

This is despite the technology to

submit forms electronically having been widely available for more than 20 years.

Most would agree an online form is

the superior channel for the customer, the insurer and the environment, yet it

is still not common practice.

Why? Well technology is not the

constraint; it’s the ability and willingness to change the existing process.

The considerable cost and effort

needed for change requires evidence of a significant return on investment - and

it’s not really there.

The life claims sector has an even

bigger challenge: Even if we can get a claimant’s information online or over

the phone, will we get doctors and other third parties to use an e-channel to

submit documents?

This will remain one of the biggest

challenges in the industry, despite the technology required being basic and

available.

2. It’s about

gathering more than deciding

A supposed benefit the robots will be

able to bring is making an accurate decision instantly.

Lemonade’s six-second claims

decision is sold as a game-changing experience.

But there is a significant flaw.

Making a quick decision is

easy. We can say ‘yes’ to any claim the instant it is submitted if we

decide to but, of course, we don’t.

We accept that to make an accurate

decision there needs to be some due diligence.

As an example, 95 per cent of group

Total and Permanent Disability (TPD) claims are accepted. It’s simple to

demonstrate that paying 100 per cent of claims - and dismissing the claims team’s - is not cost

effective, and not good business.

Putting cost and effort into ensuring

only valid claims are paid is a value-add exercise. The challenge,

therefore, has always been to gather the necessary facts to make the right decisions.

So robots must tackle the real issue - getting

information from medical parties, employers and other stakeholders.

This is a much bigger challenge than

simply making a decision at speed.

3. It’s

not worth the risk

There is already work going on to

build models that can accurately determine the likelihood of a claim being

declined, based on available claims data.

If that 5 per cent discrepancy mentioned

above for TPD claims can be detected by the robots , there

is obviously a benefit to be had.

I’ve tried myself to build machine

learning models using 10 years of claims history to see how well those 5 per

cent of invalid claims could be identified.

I’ve failed, dismally. I never really

had a chance.

How good does my model need to be

before I can say the productivity benefit it will provide (by replacing the

case manager with the robot) outweighs the risk of making an incorrect

decision?

The answer is: between 99-100%

accurate.

Why? Because any incorrect decisions

that could cost on average $250k will quickly dwarf the resource cost savings.

Further studies of declined claims

show root causes are often so complex that a machine model would struggle to

get anywhere near 80 per cent accurate, let alone 99..

In summary, there is just not enough productivity

benefit to be had to justify taking the chance.

4. The 80-20 rule means it doesn’t

make sense

Of course, robots don’t have to do

all the claims. You could have a hybrid.

Perhaps the robots can process the

simpler claims and leave the costly humans to focus on only those claims where

their advantage makes sense.

This is already happening.

Triaging low-risk claims is something our robots can assist with.

But how much benefit will this

deliver? That is, how many case managers will it eliminate? Probably not

many.

The 80-20 rule fits pretty well in the life insurance claims space. 80 per

cent of claims received are, in fact, pretty straight

forward - low-hanging fruit that could possibly be automated, albeit with some

risk.

Unfortunately for the robots, these

cases are also pretty simple for the humans, and that

80 per cent of claims volume only accounts for 20 per cent of the resource effort.

So even if every one of these cases

was automated, only 20 per cent of resources could be saved. And the likelihood

of automating that 80 per cent is low.

The risk of incorrect decisions of an

‘auto-accept’ process is such that most businesses would only be comfortable

with as much as 30-40 per cent being robot approved.

Optimistically, this would eliminate

5-10 per cent of the claims manager resource

costs. Not a great return for a significant investment and increase in

risk.

For that reason, it’s not something

that we would expect to see jobs being lost to in the near

future.

So am I cynical enough to believe that

the machine learning and AI will not have any impact on life insurance claims

processing? Absolutely not. There are huge benefits to be had.

My point is replacing the case

manager should not be the goal. It’s simply not worth it.

Improving the performance of the case

manager, however, is where the future lies.

Take a group of 10 case managers

doing the same job and measure their output and there will be plenty of

variation.

Not all claim managers are created

equal, it seems.

The potential benefits of having

those least-effective managers improve – to the level of the best - are

substantial.

Artificial Intelligence – the robots

- might just be the best tool to close that gap. By identifying what it

is that makes some managers better than others.

So I suspect the robots are coming, but

we have little to fear and plenty to gain.

ENDS